Support and Resistance Levels: Role Reversal

The concept of role reversal is one of the most significant principles in technical analysis, particularly when dealing with support and resistance levels. It describes the phenomenon where a broken support level transforms into a new resistance level, and a broken resistance level becomes a new support level. This behavior occurs due to the shift in market psychology and the balance of power between buyers and sellers. Understanding role reversal can help traders identify potential entry and exit points, confirm trends, and improve their trading strategies.

1. What is Role Reversal in Support and Resistance?

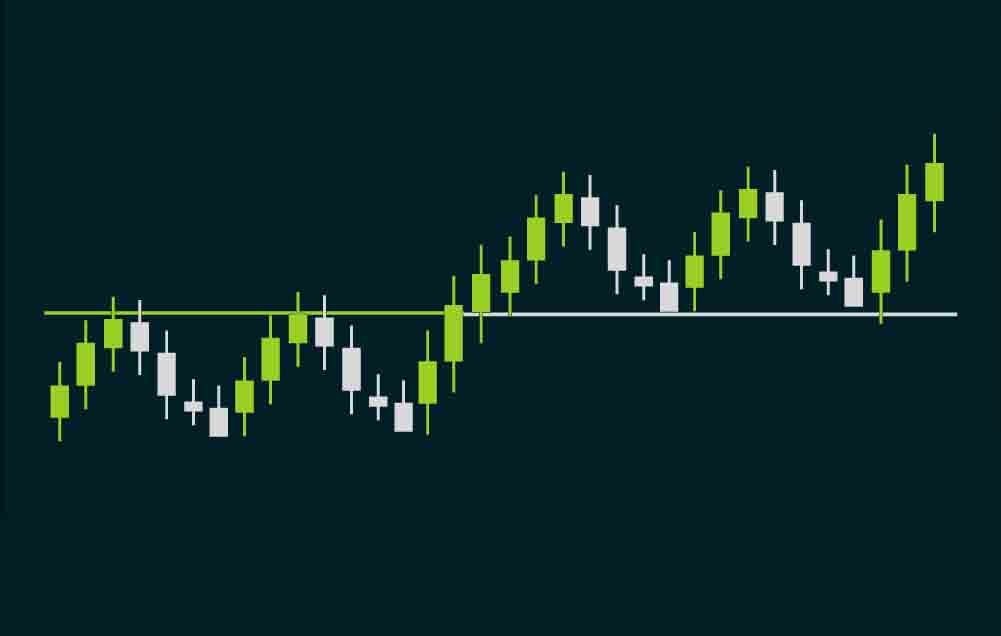

Role reversal happens when a support level that has been broken turns into a resistance level, or a resistance level that has been broken turns into a support level. This change in roles occurs because traders who were previously buying or selling at these levels now switch their positions in response to the price movement.

- Support Turning into Resistance: When the price falls below a support level, that support level often becomes a new resistance level. Traders who bought at the support level may sell their positions if the price returns to that level, creating selling pressure. As a result, the level that once prevented the price from falling now prevents it from rising.

- Resistance Turning into Support: When the price breaks above a resistance level, that resistance level often becomes a new support level. Traders who were previously selling at the resistance level may now buy if the price returns to that level, creating buying pressure. As a result, the level that once prevented the price from rising now prevents it from falling.

2. Why Does Role Reversal Happen?

Role reversal occurs due to the shift in market psychology and the behavior of traders at key price levels. The following factors contribute to this phenomenon:

- Psychological Impact: Traders often place a high value on support and resistance levels. When these levels are broken, it changes the perception of the market. Traders who missed the initial move may see the retest of a broken level as an opportunity to enter or exit a trade, reinforcing the role reversal.

- Change in Supply and Demand Dynamics: When a support level is broken, the buying interest that previously existed at that level diminishes, and sellers become more active, turning the support into resistance. Similarly, when a resistance level is broken, selling interest decreases, and buyers become more active, turning the resistance into support.

- Stop-Loss and Profit-Taking Orders: Many traders place stop-loss orders just below support levels and above resistance levels. When these levels are broken, stop-loss orders are triggered, causing a sharp price movement. The price often returns to retest the broken level, where traders who exited their positions may re-enter, reinforcing the new support or resistance.

3. How to Identify Role Reversal

To identify role reversal, follow these steps:

- Identify Key Support and Resistance Levels: Mark historical support and resistance levels on the chart. Look for levels that have been tested multiple times, as these are more likely to experience role reversal.

- Watch for a Breakout or Breakdown: Observe the price as it approaches these levels. A breakout occurs when the price moves above a resistance level, and a breakdown occurs when the price moves below a support level.

- Look for a Retest of the Broken Level: After a breakout or breakdown, the price often returns to retest the broken level. If the price reacts to this level and reverses, it confirms the role reversal.

- Check for Confirmation Signals: Use additional confirmation signals, such as candlestick patterns (e.g., hammer, shooting star), volume spikes, or technical indicators like RSI or MACD, to validate the role reversal.

4. Trading Strategies Using Role Reversal

Traders can use the role reversal concept in various trading strategies to enhance their success rate. Some common strategies include:

A. Entry and Exit Points

Role reversal provides clear entry and exit points for trades. When a support level turns into resistance, traders can use that level as a new entry point for a short position. Conversely, when a resistance level turns into support, traders can use that level as a new entry point for a long position.

- Example: If a stock’s price falls below a support level at $50 and then rises back to retest $50 from below, that level now acts as resistance. A trader can consider entering a short position at $50, with a stop-loss order just above the resistance.

B. Breakout Retest Strategy

In this strategy, traders wait for a breakout or breakdown to occur and then look for a retest of the broken level. If the price successfully retests and reverses, traders enter a trade in the direction of the breakout.

- Example: If a stock breaks above a resistance level at $75 and then pulls back to retest $75 as support, traders can enter a long position, expecting the price to rise further.

C. Stop-Loss Placement

Traders can use role reversal levels to place stop-loss orders. For a long position, a stop-loss can be placed just below the newly formed support level. For a short position, a stop-loss can be placed just above the newly formed resistance level.

- Example: If a stock breaks below a support level at $30 and retests it as resistance, a trader entering a short position can place a stop-loss slightly above $30 to minimize risk.

5. Best Practices for Trading Role Reversal Levels

To maximize the effectiveness of trading role reversal levels:

- Wait for Confirmation: After a breakout or breakdown, wait for the price to retest the broken level and observe how it reacts. Look for signs of rejection, such as wicks or shadows in candlestick patterns, to confirm the role reversal.

- Use Volume Analysis: Volume is a critical component in confirming role reversal. High volume during the breakout or breakdown indicates strong conviction, while a spike in volume during the retest confirms the new role of the level.

- Combine with Other Indicators: Use role reversal levels in conjunction with other technical indicators like moving averages, trendlines, or oscillators (e.g., RSI or MACD) to increase the reliability of the signal.

- Be Aware of Market Context: Consider the broader market conditions, such as overall trend direction, news events, or economic data, when analyzing role reversal levels.

6. Limitations of Role Reversal

While role reversal is a powerful concept, it has some limitations:

- False Signals: Role reversal can sometimes produce false signals, especially during periods of high volatility or when the price overshoots the level before reversing. This can lead to premature trade entries or exits.

- Market Conditions: Role reversal levels may not hold during strong trending markets or during news-driven events, as the price can easily break through these levels without retesting.

- Psychological Factors: The effectiveness of role reversal levels depends on the behavior and psychology of traders. If market participants do not react to the level as expected, the role reversal may not occur.

7. Conclusion

The concept of role reversal in support and resistance levels is a foundational principle in technical analysis that helps traders anticipate market behavior after a breakout or breakdown. By understanding how support turns into resistance and vice versa, traders can identify potential entry and exit points, place stop-loss orders more effectively, and confirm trends. Incorporating role reversal analysis into your trading strategy can provide a deeper understanding of price dynamics and improve your trading performance.